I put together this quick post to show you my top 5 best tools for getting started trading Bitcoin:

1. Set up trading accounts on the best exchanges

Picking the right exchanges to trade through can be the difference between making a lot of money and losing everything.

I predicted the downfall of Mt. Gox months in advance and actually put out several public warnings for people to take their Bitcoin off the exchange.

Coinbase – The easiest way to buy Bitcoin

Coinbase has raised over $100M in venture funding from angels and VC's. They're a highly-trusted digital wallet service that allows you to buy and sell Bitcoin.

They make it really easy for the average person to get started with digital currencies. In fact, you can link your Coinbase account to your checking account and quickly transfer money to and from the exchange.

Bitfinex – A very liquid exchange with the ability to short Bitcoin

Bitfinex is one of my favorite places for shorting Bitcoin. Aside from a few technical glitches in the past, this exchange is a reliable place for active traders.

They consistently rank as one of the top exchanges by trading volume for the U.S. dollar.

Poloniex – The best place to trade altcoins

Poloniex is a newer exchange that gained popularity because they offering margin trading and shorting on many of the most popular altcoins.

This is actually the first place I started trading Ethereum, and thanks to Poloniex was able to catch Ethereum's first massive bull market.

Key Point – Don't trust exchanges to act as your bank

Look, the reality is that Bitcoin trading is still the Wild West. Several exchanges have been hacked, gone bankrupt, or actually stolen their customers' digital currencies.

We can use exchanges to place trades and make money, but assume the worst. Don't trust them to act as a bank account. Many exchanges are offshore and don't have insurance for you.

As we'll talk about more in tool #4, I don't leave a majority of my cryptocurrencies on exchanges. I want to hold and control them in case the shit hits the fan at an exchange.

2. Use the best charting tools

If you want to be an active trader, then you need to use the best charting and order execution tools.

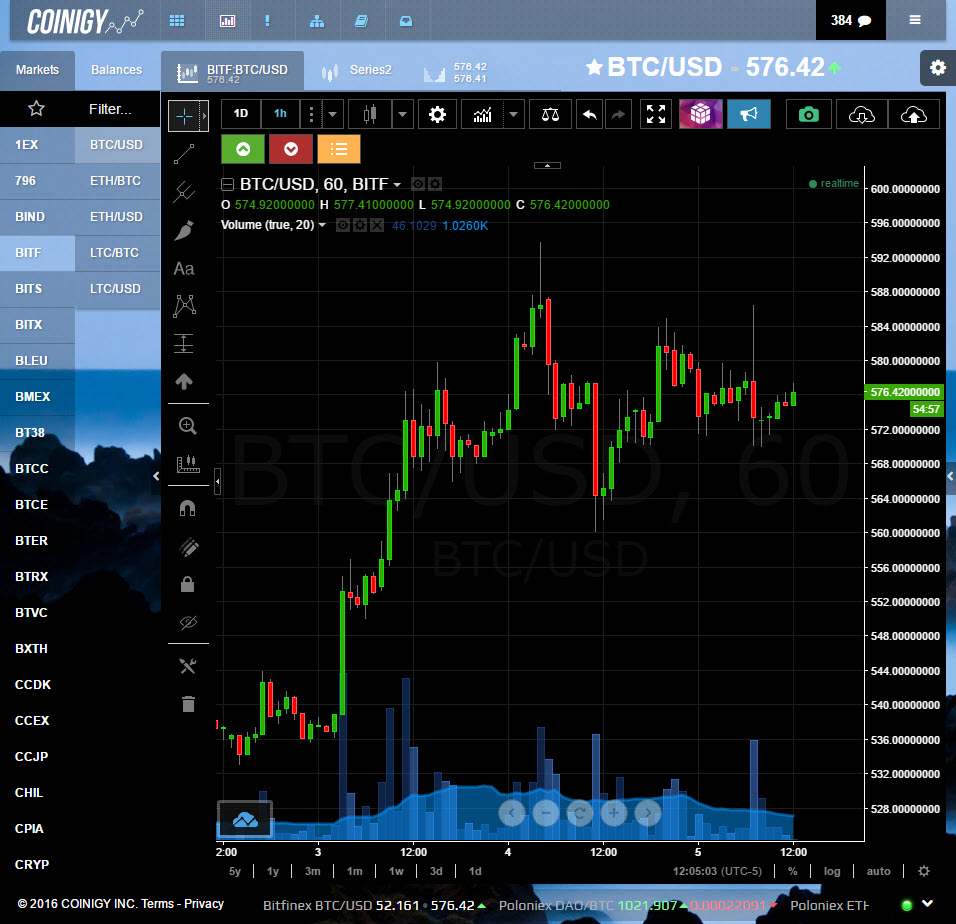

The best charting and trade analyzing tool I've found is Coinigy.

Coinigy is an all-in-one trading platform that has charting and order execution for all of the important digital currencies and exchanges.

You can link your accounts to Coinigy, actually place orders, and track your trades in a single location.

They have a beautiful charting interface with all the drawing tools and indicators you'd need to analyze technical analysis.

3. Set up mobile charts & alerts

I don't sit at my computer and watch Bitcoin charts all day. In fact, on any given day I could be on a flight, in a meeting, or on a beach somewhere around the world.

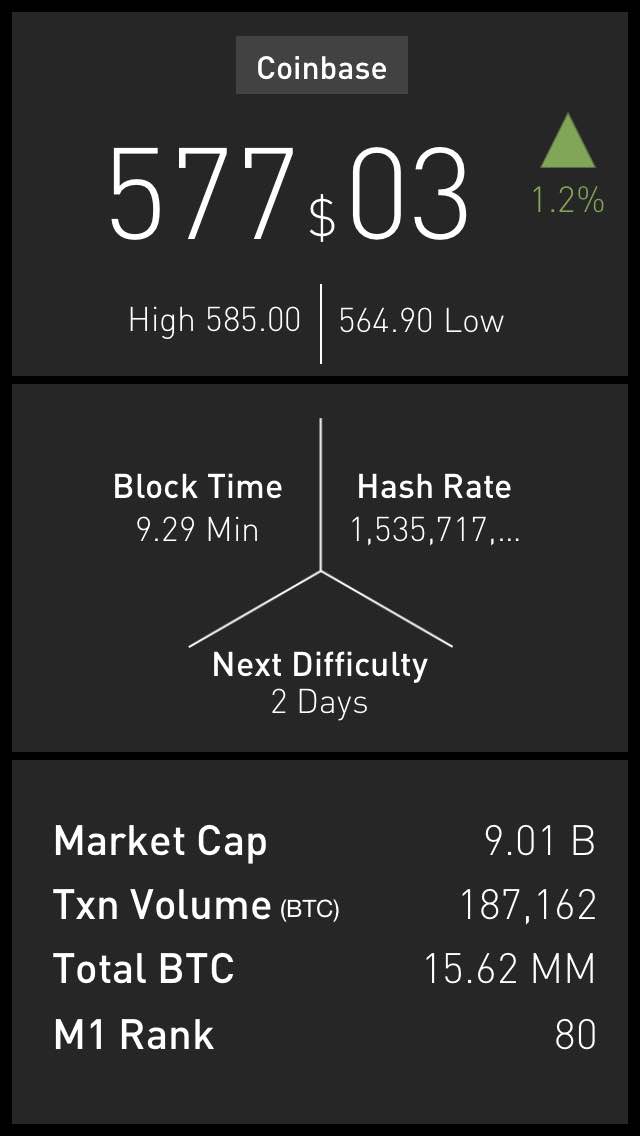

So it's important for me to be able to check on Bitcoin's price from my smart phone.

ZeroBlock is a very simple and powerful app that allows you to see a simple price chart for Bitcoin.

You can also set price alerts in case Bitcoin breaks a key price level.

4. Move your trading profits offline into cold storage

As I mentioned in tool #1, you don't want to trust exchanges to act as bank accounts to hold your Bitcoin and altcoins.

The safest place to store your digital currencies is in cold storage.

Cold storage means a wallet that's not connected to the internet. This keeps your coins safe from hackers and thieves.

One of my favorite cold storage tools is Trezor. This is a hardware Bitcoin wallet that offers ultimate security.

There are many types of cold wallets. It doesn't matter if you use paper wallets, hardware wallets, or even computer wallets…

Just make sure you understand how your Bitcoins are secured and stored!

5. Join a high-value trading community

Most people that attempt to trade lose money. There are many reasons why such a large percentage of people lose money, but the top reason is a lack of training and education.

Trading is a performance activity just like golf, chess, or poker…

And if you don't take the time to learn the most effective strategies and techniques, then odds are you'll lose money to more skilled traders.

As I've demonstrated from years of profitable Bitcoin trading, you need a solid strategy for when to pull the trigger on an entry, and how to effectively manage a trade.

Once you learn the basics of how to trade Bitcoin, then it's time to join a community of traders.