The idea of trading financial markets full-time for a living is sexy.

Wake up, grab some coffee, stumble into your home office, trade for a couple hours…

And MAKE THOUSANDS OF DOLLARS EVERY DAY!

That sounds awesome, except in reality trading doesn't work that way…

Not even close.

If you think you can create a “steady, consistent income” trading the same strategy over a long period of time, you're in for a very rude awakening.

How do I know?

Well, I've been OBSESSED with trading and investing in financial markets ever since the 10th grade.

For the past 16+ years, I've invested thousands of hours in front of my computer screen testing different strategies and trading a variety of markets.

I've seen first-hand how profitable strategies turn into losing strategies over time.

So in this post, I'm going to explain why you shouldn't rely on the markets for consistent income, and the 5 steps for effective trading.

First, a quick history lesson…

How Market Conditions, Competition, and Technology Always Kill Profitable Trading Strategies

What worked last year (or even yesterday) may not work today.

Profitable trading strategies always become unprofitable over time for at least one of these reasons:

1. Market conditions change – major shifts in volatility, trading volume, or liquidity invalidate trading systems built on back-tested results

2. Competition increases – less “dumb money” and more professional traders create more efficient markets

3. Technology improves – faster order execution and the ability to quickly analyze large amounts of data push out less sophisticated traders

I want to show you a few examples of how these forces have played out over the past several decades…

To start, the old-school pit traders started to become obsolete when computer trading was introduced in the 1990's.

Their inability to react quickly to new information and place fast electronic orders put them at a massive disadvantage.

Today, the trading pits are a ghost town compared to the good ol' days.

Then came first electronic day traders…

One of my first mentors was a full-time day trader in the late 1990's. At that time, stocks traded on the fraction system (1/16's instead of pennies).

He made a sizable daily income by scalping dozens of stocks a day…

Until it stopped working.

You see, in 2001 stocks switched to the decimal system ($0.00). His scalping strategy was killed due to tighter bid/ask spreads and increased competition from more traders that could access faster DSL internet connections.

Next, in 2008 we saw unprecedented volatility during the global financial crisis…

And all the “emotional money” gave day traders an edge. This volatility gave way to another day trading gold rush.

The stock market's inefficiencies and wild volatility gave some traders the opportunity to make a career's worth of profits in a single year.

But just like all the strategies before it, this style of day trading slowly started to become obsolete.

This time, day traders suffered because of all three factors – changes in market conditions, increased competition, and massive leaps in technology.

Around the same time of the 2008 financial crisis, there was another monster lurking behind the trading action…

High-frequency computer algorithms.

At that time, I was day trading the futures markets…

And over the next few years, I watched the stock market go from a relatively level playing field where independent traders could make money, to a highly manipulated market that pushed out discretionary traders that didn't have access to PhD mathematicians and microwave towers to push laser-speed order execution.

In addition to the increased competition and technological disadvantages, day traders were also facing falling trading volume and volatility… they would eventually fall to historic lows.

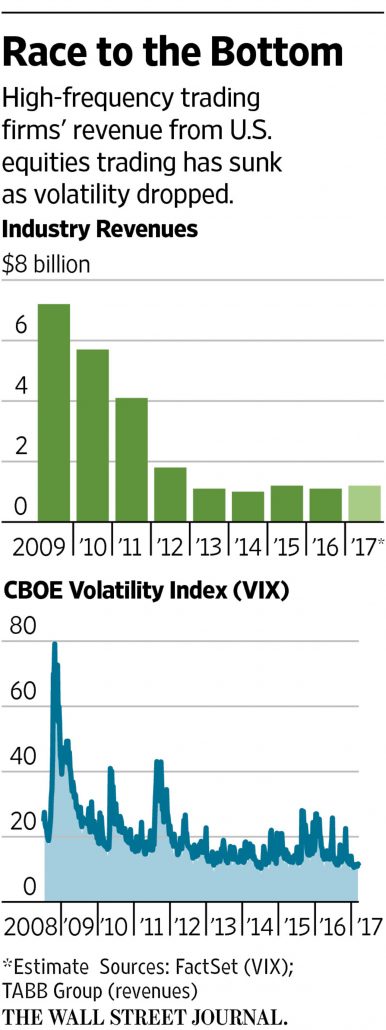

Not only did those 3 factors crush independent day traders, but even high-frequency trading firms started struggling to turn a profit.

As the Wall Street Journal recently reported in this article, even the best high-frequency trading firms with the deepest pockets are struggling to make money in this low volatility environment.

“Such strategies are more successful when markets are volatile because big price swings offer traders more opportunities to capture profits. But volatility has come down drastically since the years just after the global financial crisis. The CBOE Volatility Index, or VIX, a measure of U.S. stock market volatility, has averaged just 11.6 so far this year, down from 24.2 in 2011, according to the WSJ Market Data Group.”

In fact, the most profitable way to trade the stock market over the past several years has been to buy a low-fee index fund an let it ride!

As I talked about at length here, in 2013 I got fed up with the stock market and went all-in with cryptocurrencies…

Because I saw the perfect storm.

While the stock market had terrible market conditions, extremely high competition, and I was at a massive technological disadvantage…

It was the exact opposite with cryptocurrencies:

- Market conditions – Even in 2013, I noticed that cryptocurrencies (mostly bitcoin at the time) were the most volatile and fastest growing market on the planet.

- Competition – There were virtually no professionals trading bitcoin, and most of the capital inflows were from “dumb money”.

- Technology – The disjointed trading exchanges and low prevalence high-frequency computers gave me a HUGE advantage.

Since then, the price of bitcoin has been incredibly volatile (a trader's best friend), and we've seen explosive growth in other cryptocurrencies.

I've noticed more professional traders hopping on the crypto-bandwagon, and with the CME launching futures, I expect to see volatility slowly fall over the next 3-5 years.

There's still a MASSIVE amount of opportunity in cryptos, but at this point in the 5-phase market cycle, trading crypto is all about patience.

5 Steps For Effective Trading & Investing

For me, trading and investing are all about being patient and waiting for those rare moments in life where you spot a high-probability opportunity with asymmetric risk-to-reward…

In other words, the goal is to find a trade or investment that has a very high probability of winning, with massive upside profit potential and limited downside risk.

An example of this kind of trade is buying bitcoin at $200 in 2015 when everyone was trashing it.

I believed it was on the cusp of mass adoption and the risk was limited since the price crashed over 80% to pre-2013 bubble prices.

I can't emphasize this enough – These high-probability, high reward-to-risk opportunities don't come along every day!

You'll get run over if you try to earn a consistent amount of money every day, week, or month.

Many trading gurus will say cliches like, “Trade for consistently daily base hits. Don't swing for the fences.”

In my experience, this is a great way for your trading account to experience “death by a thousand cuts”.

You might have to wait YEARS for the perfect storm of good market conditions, low competition, and a level technological playing field…

And that's OK.

I believe it's much easier to make a life-changing amount of money during a “perfect storm” than trying to grind it out forcing low probability trades in unfavorable market conditions.

If you're serious about trading and investing, then the best plan is to develop your skills and mindset TODAY, then be patient and wait for those big opportunities.

It's so simple, but very few people are willing to do it. Most people want the short-cut or easy path.

Sorry, it doesn't exist.

This applies to real estate investing, the stock market, cryptocurrencies, angel investing, entrepreneurial ventures, or any other type of investing.

Look, I know that's not what most people want to hear.

The average new trader wants to be told there's a system that can guarantee massive returns with little or no risk… on their own schedule.

Sadly, that shit does NOT exist.

The best mindset I've found for trading and investing is to think of yourself as a hunter waiting for the big 12-point buck.

You don't want to waste your bullets and time shooting at rabbits. You'll just mentally burn out and run out of ammo before the massive opportunity walks right in front of you.

Here are 5 steps to help you make money as a trader or investor:

- Develop your skills. Do this today. Develop the technical and mental skills NOW so you'll be ready when a big opportunity comes along.

- Have at least one non-market related steady source of income you can use to pay your bills and stack “risk capital”. If you try to trade with money you need to pay your mortgage or buy food, you'll make stupid decisions and lose money, period. Having a steady income source will also keep you from feeling like you NEED to make money by a specific date. This is a great way to force bad opportunities.

- Wait for those high-probability, high reward-to-risk opportunities. They won't happen on your schedule. Be patient.

- Strike while there's low hanging fruit. Be prepared and know when to pull the trigger.

- When you lose either the favorable market conditions, competitive advantage, or technological playing field, get the hell out of dodge and STOP TRADING when the markets aren't doing exactly what you want.

Look, trading isn't for everybody. It requires a lot of focus, discipline, patience, and goes against a lot of the things we're taught growing up…

But it can also be extremely rewarding IF you follow the right path.

I've had several years where I struggled and felt like I wasted years of my life… And I've also had some gains that have changed my life forever.

It all boils down to two words: preparation and patience.