In this post I'm recapping my Bitcoin predictions and trades. To date, I've posted 19 trade predictions or alerts to my trading students. Of these trades, 15 went on to hit my targets, 2 failed, and 2 were breakeven trades. If we exclude the breakeven trades, I'm currently standing at an 88% accuracy rate. I don't say that to brag, rather show you the potential in trading Bitcoin.

Right now we have a very unique trading opportunity. This market is very volatile, has a very low level of trading competition, which makes it really favorable for professional traders. I don't know how long these market conditions will be this great, but with the NYSE and major investment banks pumping money into Bitcoin exchanges, I only see more upside for Bitcoin and digital currencies.

A Quick Introduction – How I Got Started Trading Bitcoin

When I first became interested in Bitcoin in 2013, I first thought it was a scam, pump and dump, or fad that was gonna go away. But the more I looked into it the more I realized that Bitcoin and digital currencies were here to stay, and were very likely going to change the way money worked. I also saw the huge potential that it had to bring basic banking services to the billions of people that are currently suffering.

I started doing research learning how to make money trading Bitcoin. At first, I had very little trust in the Bitcoin exchanges because they were not transparent, many were based overseas, and I felt like the management running the exchanges was inexperienced and questionable at best. In fact, I predicted the downfall of the biggest Bitcoin exchange months in advance.

In November 2013, Bitcoin was on an insane rip from $100 to almost $1000. I posted this blog post basically pleading for people not to invest at these ridiculously high prices. In fact, I was searching for places to actually short Bitcoin.

I started by placing small trades learning how to execute orders through the exchanges, and studying the inner workings of the Bitcoin protocol. Once I was comfortable with placing trades, I recognized how good the volatility and opportunity was with trading Bitcoin.

I started publicly posting my trades and predictions on my TradingView.com profile, and quickly gained a sizable following because of my accuracy. In this article, I'm showing you each of the major predictions and trade alerts I've posted so you can learn how to catch these big moves.

Trades #1 and #2 – First Major Bounce Play, And First Short Opportunity

Throughout the later part of 2013 the media was extremely bullish on Bitcoin. “Bitcoin is going to take over the US dollar”, read the headlines. But in early December, Bitcoin's price topped out above $1000 per coin. Then within just a couple of days it came crashing down over 40%.

The first publicly posted trade that I made was on the rebound after the panic selling started to subside. A lot of people on twitter initially called me crazy for buying and said that this was the beginning of the end for Bitcoin. But they were eating their words when my trade was up over 35% in two days.

However, even though I was immediately bullish, that didn't mean that I thought price was going back over $1000. But many people regained their faith in Bitcoin when price retested $900. And I told all my followers that price was not going back above 1000 for a very long time, which was another very unpopular opinion. Unfortunately there was a lot of people that had bought have very high prices who were just hoping and wishing that price would stay at very high levels.

So one thing I noticed a few days later was that price was not sustaining above 900, because there were a lot of “bag holders” that were selling into strength because they wanted to get out at the highest prices possible. This is when I made my first short prediction because I saw a very high probability that price was can get a secondary crash. Unfortunately I wasn't set up to be able to short yet, so I wasn't able to take the trade, but my prediction was correct nonetheless.

Trade #3 – My Biggest Winning Trade To Date

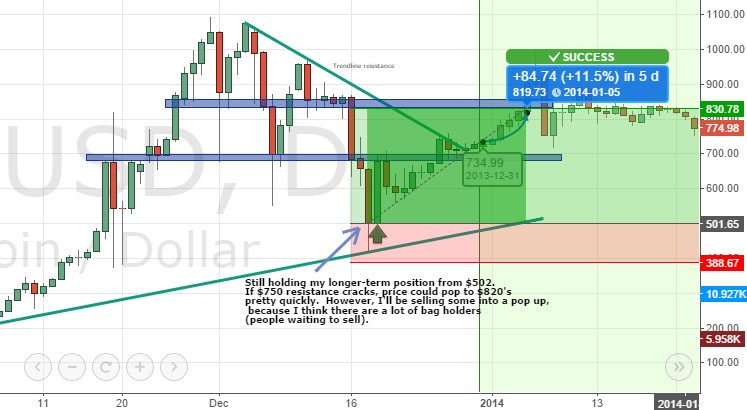

After Bitcoin failed to hold up and break back up above $1000, we saw another huge panic that took price from over $800 down below $500 in a short period of time. And yet again, while everyone was panicking I bought the dip at $502.

I had a long-term prediction that within a few days we would come back up to retest prior support turned into resistance at $819. As you can see from the chart below, this worked out beautifully and followed the timeline I predicted.

Trade #4 – Secondary Breakout To Squeeze Early Shorts

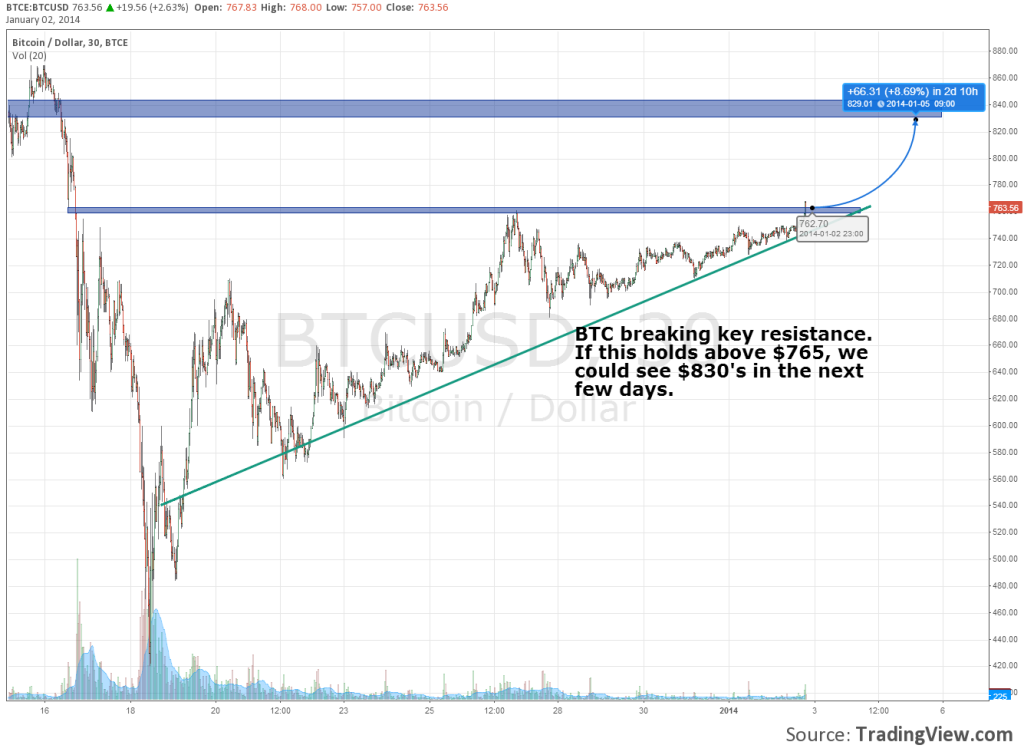

After the second big crash, Bitcoin went from being the media's golden child to just another fad or bubble. And with the recent availability of being able to short Bitcoin, nonbelievers began making huge bets that Bitcoin was gonna come crashing down for a third run.

However, what early shorts didn't recognize was that Bitcoin was in a “healthy trend”. In fact I made another prediction that we would see a breakout to come up even further in test $829 in just a couple of days. And just like before, Bitcoin followed my prediction and timeline very closely.

Trade #5 – A Picture-Perfect Short Pattern

After learning about some exchanges that were offering shorting on Bitcoin, I decided to trade through the ones I trusted the most and hunt for good shorting opportunities.

In the chart below I recognized the classic head and shoulders pattern, which proved to be another great set up that crashed for an 11.76% accurate prediction.

Trade #6 – Buyers Beginning To Give Up

During February 2014, it was important to recognize that there were still a lot of people that were stuck upside down from buying at or above $1000 per coin. I noticed that every trend was met with very heavy selling volume, so I was very conservative looking for long trades and knew that there was a high probability that the trend could fade.

One thing I always say is, “the market likes to take the stairs up in the elevator down”. In other words, uptrends are typically slow and steady, where panics are fast and violent. This next trade is a perfect example of this.

Once it was clear that 850 was strong resistance in Bitcoin, I made a prediction that we were to go down and test 680s and possibly go for more. From what I remember, there was some negative news around a Bitcoin exchange that also acted as a catalyst for this selloff.

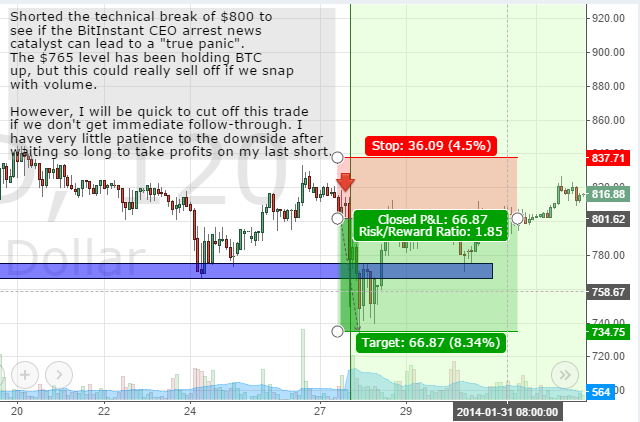

Trade #7 – A Quick Short Based On News Panic

As you can see in the notes on the chart below, the CEO for BitInstant was arrested on money laundering charges, which created a fast panic. I did a live trading video and live tweeted my thoughts with entry and target levels on this trade. And sure enough as soon as we hit the high probability target zone of 735's, buyers stepped in and brought the market back to equilibrium.

Trade #8 – A Losing Reversal Trade

After having called about a half dozen very accurate predictions, I knew I wasn't going to be 100% for long. In March 2014 I saw the 550s support zone as a place where the market could potentially reverse and go back into a bull trend. However, as I told my subscribers, this was a lower probability trade because I was speculating without much confirmation that this market was going to go back into another upside trend.

The most important lesson I can talk about his risk management. On this trade I wasn't buying and hoping that price would just go up to the moon. Rather, I saw the opportunity for a discounted price where I wouldn't be chasing, but I had to realize that we were going against a strong trend line of resistance.

As soon as price broke back under $600, it was clear that the bear trend was not over and the smart move was to not fight the selling pressure.

Trade #9 – Another Fast Breakdown

After my long trade failed, I told everybody on tradingview and twitter that I was only interested in shorts until the trend reversed. I made a prediction in a video two weeks ahead of time based on the chart below. Price cracked quickly and I took this for just a quick scalp trade, but it was nice to see how a prediction weeks in advance was still accurate.

Trade #10 – The First “Real” Bull Trend Since The Crash Of 2013

Even though I was very conservative in making calls for the bottom in Bitcoin, I saw the first strong potential for a reversal in May 2014 when $400 was holding as strong support.

As you can see in this chart I was accumulating a long term position around $450 looking to see if the 500s would snap as resistance. Eventually it dead and we got a healthy bull trend up to the mid-600s.

I was very cautious on my Longs, so I was taking profit into strength.

Trade #11 – The Bull Trend Eventually Fails

After a healthy pullback in late May 2014, I anticipated that if the bull market continued we would see at least a retest of $680 and possibly 100% Fibonacci extension into the mid-$700 range.

But eventually bulls gave up at 640, the volume faded, and when 600 failed to hold his support again we had another washout. I ended up losing some money on my longer-term investment, but just like the first losing long I knew that risk management was really key here.

Trade #12 – Consolidate & Crack

While it was becoming apparent that the long-term bull trend was probably coming to an end, I noticed a short term consolidation pattern into resistance that was likely to crack. I was live tweeting about a short entry I had around $609. I target was in the mid-500 level, which it ended up hitting in just a couple of days. Since I still had part of my long-term long position on the table, this was more of a hedge to counteract the losses I was incurring in my long-term account.

Trade #13 – Beautiful Breakdown Setup, No Entry For Me

There were a few times over the past 18 months that I made predictions I wasn't actually able to get a fill because I was either flying, sleeping, or trading another market. This is an example of a beautiful breakdown at $560 right had prepared my students for a short opportunity that eventually ran over 20% in just a handful of days.

Trading isn't about catching every single move. Rather it's about having an idea where the odds are in your favor, knowing how to manage risk, then showing up and being prepared for the trade. Professional traders miss good trades all the time, where rookie traders will chase bad trades because of the fear of missing out.

Trade #14 – There's Always Another Opportunity

After the prior breakdown set up at 560, the market gifted us with another breakdown trade at 480. I alerted my students that this was likely to run down to at least the hundred percent Fibonacci extension at $378 which it exceeded by over $50 a coin.

Trade #15 – Trade Against The Herd, Even If They're Panicking

One of my favorite trades in the Bitcoin market on the long side has been to buy when everybody else's panicking. This is an example when we had a panic from 330 down to 280. I sent an alert that I was buying in the 280s and would look to cover in the mid-300s. I covered most of my trade by the time we hit $345.

Trade #16 – Sometimes A Trade Will Work & Not Hit Your Target

In November 2014 I sent an alert that we could get a crack below $340 for a retest of support at $311. The trade did what I thought but didn't quite stabs through our price target. So to be fair, even though this trade worked I don't count it a full win since it didn't stab through the main target. In this case it's a scratch.

Trade #17 & #18 – Two Big Trades To Kick Off 2015

The first trait of 2015 would turn out to be my second biggest winner to date. Very similar to the bounce trade in October 2014, I sent an alert to my subscribers that I was buying it $188. My students at over 17 hours to get into this trade before it moved up into the low to 220s which was my first target. I closed a good portion of the trade but knew that this trend was probably not over.

Then, during a live trading webinar for my platinum mentoring students, we had a breakout above $220 which happened to be a trigger point for another entry. So a lot of us bought more in the $218 to the $225 range.

In the chart below you'll notice that I sold up in the $280 and as high as $304 making it a 62% when from my first entry of the year. I actually got pretty lucky here because the reason why price went parabolic from 260s to over 300 was due to Coinbase posting news that they were now an insured exchange backed by the NYSE. I just landed in Canada after flying from Hawaii, and was able to close my trade before it crashed back down to the 260s.

As I tell my students nearly every day, when price speeds up relative to the prior price action that usually unsustainable and will crush back down.

Trade #19 – Bull Trend Cut Short

I issued a buy alert on this chart on a break of $240. Unfortunately the trade triggered in the middle of the night and I didn't get a fill on the initial breakout. So, I had to buy at 246 before the secondary breakout.

You'll notice that this was a great trend until there was strong selling that broke us back below to 60. This was caused by news of a smaller exchange getting hacked. I mention this because it's important to keep in mind that you can't predict or anticipate everything that's going to happen in the Bitcoin community. Sometimes you'll have good news, other times will have bad news, but the most important thing is to have a plan of action for each trade no matter what the market can throw at you.

So even though this trade went about $25 over my alert price, ice consider it a scratch trade since the trend failed so abruptly.

The Future For Bitcoin & Digital Currencies

Almost every day somebody asks me, “is this the bottom for Bitcoin?”. My answer is always the same – I have no clue where Bitcoin's price is going to be a year from now or even a few weeks from now. There are so many variables and constant changes in the Bitcoin community that it's damn near impossible to predict out more than a few days in advance.

I've had a really great run and fun time trading Bitcoin so far, and I hope that continues in the future. But there's a reason why the old disclaimer says “past performance is not indicative of future performance”. The trading arena for Bitcoin is really fun and relatively easy right now, but it will absolutely become more competitive in the future when more professional traders step into this market. So my thought is “get in while the gettin' is good”.

Nobody knows of Bitcoin is going to be THE digital currency that wins in the long run. In fact there are other currencies and technologies that are trying to compete with Bitcoin every single day. To date, nothing has been able to solve a big enough problem to become bigger than Bitcoin, but I'm constantly keeping my finger on the pulse of the digital currency community to see what's coming down the line.

I would encourage anybody who's serious about taking control of their financial future to pay close attention to digital currencies. This doesn't mean that you should just buy and hope for the best. As I've said many times, I'm a trader first, not a pumper for Bitcoin. Just like major investment banks are starting to notice, I to see huge potential and change coming for currencies over the next couple of decades.

Trade smart. Build wealth. Live well.