In my last post about business leeches, I talk about the need for entrepreneurs to become excellent problem solvers. Although real estate has shown signs of a recovery for a few months now, there is still a major gap that presents opportunities for entrepreneurs and real estate investors.

The problem: We have the highest real estate affordability in years, but tight lending restrictions and new regulations make it difficult for investors and retail buyers to purchase properties.

A solution: Those who provide creative financing to niche segments of the real estate marketplace have a massive opportunity. For example, I'm offering short-term financing to real estate investors so they can pay cash for homes at deep discounts.

Why Financing Real Estate Investors Can Be an Excellent Investment

I'll be the first to tell you that lending money in real estate is risky. After all, I entered the mortgage business at the age of 16 and became director of the subprime lending division at a publicly traded company before I could order a beer. I had a backstage pass to the lending that caused the mortgage crisis. Fortunately, I had the foresight to get out of the business before “it” hit the fan.

Today, I'm approaching real estate lending from a totally different perspective. For one, I'm lending my own money instead of dealing with the secondary mortgage market. Second, I'm making lending decisions based on the strength of the deal, rather than the strength of the borrower. In other words, I would be just as happy if my borrowers defaulted, because I would end up with a slam-dunk real estate investment.

3 Reasons Why Creative Investor Financing Creates Low-Risk Opportunities:

- Seasoned real estate investors buy and sell based on numbers

- Lending at about 50% loan-to-value offers multiple exit strategies if you foreclose

- Short lending times offer better diversification and higher annual yields

How to Profit From the Gap Created by Lending Restrictions

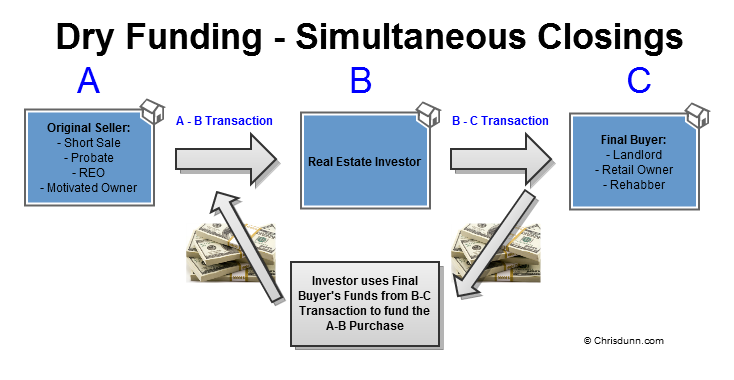

Prior to the mortgage crisis, it was fairly simple to do dry closings. A dry closing is when you purchase a property, but funds aren't disbursed to the original seller right away (A to B transaction). The funds will typically be disbursed after you sell the property to the final buyer (B to C transaction). In other words, it's like using the funds from selling the property before you pay for it.

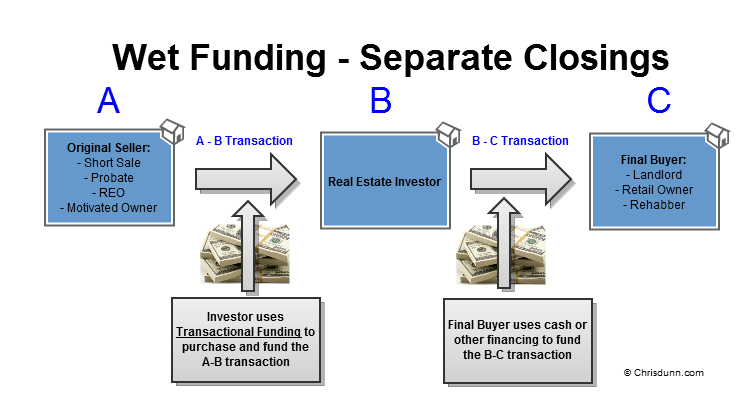

Today, dry closings are much more difficult, and more are requiring wet closings. This is when you purchase, close and fund your purchase prior to selling the property. Some investors will want to borrow the funds to purchase the property before they resell it. This type of financing is called transactional funding.

This type of loan is great for investors because they can wrap all acquisition costs into the loan, and there is no credit check because the loan is funded based on the strength of the deal. The loan term ranges anywhere from 24 hours up to 60 days. Typical fees are in between 2% and 6% of the loan amount.

Transactional Financing Example – How to Earn 5% Every 30-60 days, Tax-Free

One of my experienced investors found a good deal through probate, which means he bought it from the heirs of a deceased person at a big discount. His plan was to wholesale the property to another investor, who would either complete a rehab and resell the property or do a minor rehab and lease the property.

3313 Wynmore – The numbers:

- After repaired value (based on Broker Price Opinion): $73,464

- Purchase price: $30,000

- Loan-to-value: 41%

- Estimated repairs needed: $15,000

- Other estimated expenses: $10,000

- Potential profit for rehab investor: $18,464

- 60 day note: 5% fee to me

If the deal went through as planned, I'd make 5% within 60 days for signing a few documents while day trading on the beach in Puerto Rico. Worst case scenario: I'd take the house back and add it to my “hands-off” rental portfolio.

Sure enough, I was paid off in about 30 days, with more deals in the pipeline ready for funding. The best part? The profits generated through this type of lending are tax-free because I'm lending through an IRA.

Creative Real Estate Lending vs. Investing in CD's

Real estate lending isn't for everyone, but it can fast-track your retirement plan if you do it right. Since we know mutual funds are a negative-sum game, let's look at another hands-off investment, CD's.

According to Bankrate.com, here are the best available interest rates for CDs:

1 month CD: .25%

1 year CD: 1.25%

5 year CD: 1.75%

Recent inflation rates are in between 1.41% and 2.93%. This means that, if you invest in a CD, your real interest rate would actually be negative.

So, instead of playing the losers game of mutual funds or earning negative real interest in CDs, you could compound profits by churning these types of deals month after month.

For example, if I can keep at least 75% of this account invested in these types of deals for only six months out of the year, I'd expect to earn an annual return of 22.5%. If I could keep the entire amount invested for longer, then the returns could be even higher. Not a bad return for signing a few documents and depositing checks.

======================

Links & Resources: