A few weeks ago, everyone got news that one of the biggest pump and dump promoters shut their doors. According to this article, the 26 year old owner of AwesomePennystocks.com has shut down the business and is hiding from the FBI and the Canadian Government in Lebanon.

“Babikian's wife Alima Beg claims in divorce papers filed in September that Babikian has amassed a fortune of more than $100 million by running a business in which ‘he acquires, directly and indirectly, large stakes in penny stocks, then ‘promoting' these penny stocks through multiple web sites, thereby causing the price of these stocks to run up, so that he can ‘dump' the stocks with enormous profits.'”

I think this is going to have huge implications for penny stock traders. What has been working well for both penny stock promoters and penny stock short sellers is starting to change.

How Penny Stock Pump & Dumps Have Worked In The Past:

First, a shady company decides to go public. 99.99% of the time their goal is not to run a real business, but to just hype up their stock so they can make a ton of money.

Since they aren't a “real company”, they have to list their stocks on the Over-The-Counter (OTC) or Pink Sheets markets. This is basically the Wild West of the stock market where ignorant speculators and greasy Wall Street types chase dreams of massive profits.

Next, the company hires a “marketing firm” to promote their stock to the general public. They create a story around why this stock's price is going to increase dramatically in the near future, thus sucking in unsophisticated investors. The promoters have been getting paid anywhere from $1,000 to over a MILLION bucks – just to send emails.

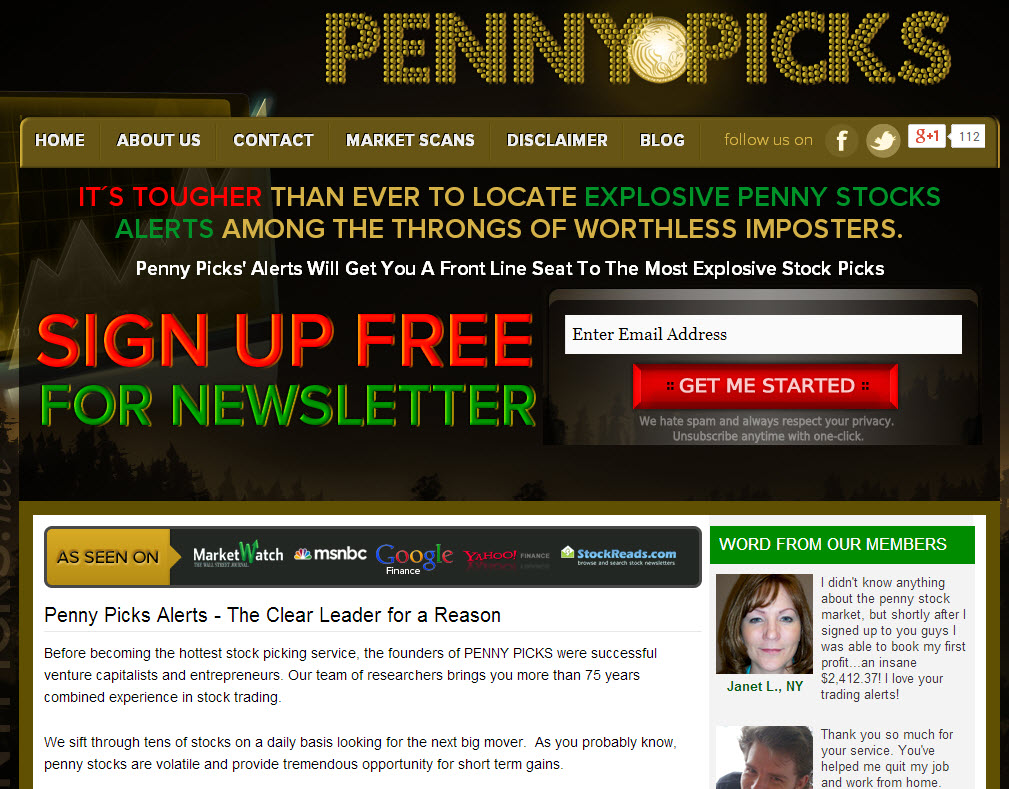

Before the internet boom and spam email, promoters used boiler room phone sales and direct mail spam to suck in hopeful investors. And over the past decade they've been hammering spam email through cheesy optin pages like this:

After the stock price jumps a little bit, the company continues to send email spam with a “told you so” message, which creates even more buying. Eventually the stock goes parabolic and crashes just when it looks to be gaining the most.

The result almost always leads to most of the “sheep investors” losing a massive percentage of their investment. And the process continues over and over… Until now.

Here's a couple chart examples of some recent successful stock promotions. Notice how the stock starts very cheap and ramps up as the stock promotion emails hit inboxes. Then, notice how fast it crashes after shooting to the moon.

Why Penny Stock Email Promotions Could Become Less Effective

Thanks to the internet, a growing number of “mom and pop investors” have access to better information. Now your average investor can gain cheap access to breaking news and company financial information to make more informed investing and trading decisions.

And after burning ten's or hundred's of thousands of investors, it seems like the well has run dry for Awesome Penny Stocks and other sleazy promoters alike. It's kind of like an MLM (network marketing company) that reaches the tipping point of collapsing because there's a lack of new participants.

In trading, the more people who are “in-the-know”, the less edge you have. So for penny stock promoters, it seems like the scales have tipped in favor of knowledgeable traders.

What's Next For Penny Stock Traders?

It's hard for me to speculate on what's going to happen next in the Penny Stock Trading World since I trade mostly “real” companies that trade on the NASDAQ or NYSE.

And look, I'm not saying that all penny stock promotions are dead! It's just my guess that they're not going to be as effective as they once were — Unless stock promoters find a new way to find massive amounts of ignorant investors.

My best advice is to use a trading strategy that is scaleable and doesn't rely on market manipulation to move the price of a stock. In this free Stock Trader Formula video series, I talk about my criteria for the best types of stocks to trade.

No matter what market or strategy you're using, make sure you become an independent thinker. No guru, newsletter, or software program can make you successful without you going through the process of learning to trade.