During the real estate boom of 2005, I heard a story that changed my life. The late real estate mogul, Jack Miller told me a story about how he made a fortune buying real estate during the 1980's Savings & Loan bust (which was very similar to our latest credit crisis). Sitting on his beautiful bay front home, he said, “When things are at their ugliest, buy as much real estate as you can“. It kind of reminded me of Warren Buffett's old saying, “When people are scared, be greedy; When people are greedy, be scared.”

From that conversation, I knew the “Global Financial Crisis” and “American Housing Crash” was the beginning of an incredible opportunity…

Thankfully, Jack's advice took hold of my entrepreneurial spirit. Over the past couple of years I've been buying and investing in real estate like crazy. In fact, last year I was able to earn over 20% passive income in my tax free IRA. This was without lifting a finger thanks to my kick ass team that buys and sells our highly profitable deals.

Early Signs Of Huge Opportunity – And Why Slackers Always Lose

In the late part of 2010 we saw early adapters (AKA smart investors) quietly buying up massive quantities of real estate. This happened despite the fact that foreclosures were at an all time high!

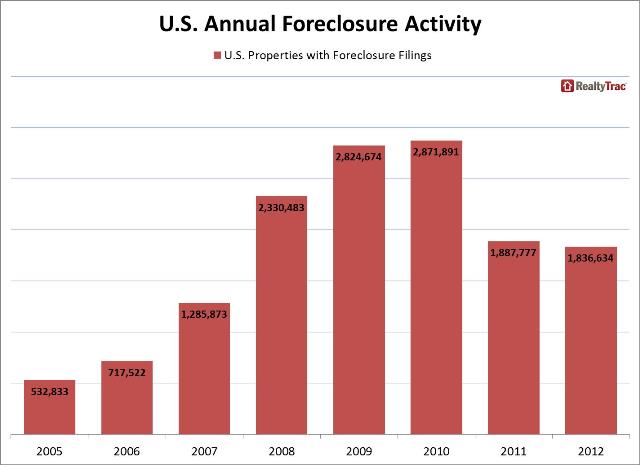

See the chart below that shows U.S. foreclosures at record highs in 2010, which is when smart investors started buying up property.

Even though everyone knows about the cliche that says “buy low and sell high”, most people do the exact opposite. They buy when things look great, and sell when things look bad. An example is how many people bought homes at the height of the market in 2005, and didn't buy at rock bottom prices in 2010, which lead to record amounts of people losing money.

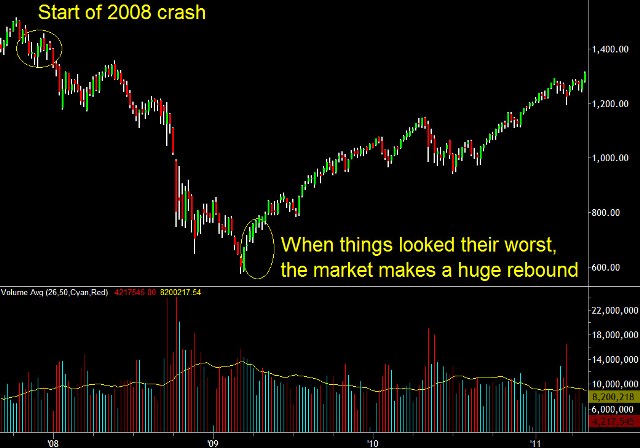

Another example is how most people sold their stock positions for a big loss as the market was crashing in 2008. Then, they failed to recognize the market bottom in early 2009, and missed out on the massive rebound over the next few years.

One Of The Best “Under The Radar” Real Estate Markets For Investing

Although home prices have risen about 10% year-over-year, I think there's still a huge opportunity… but ONLY if you play it smart by investing in the right markets with the right strategies.

Many investors are focusing their time and energy into markets that are over-saturated with investors like: Las Vegas, Detroit, Phoenix, California, and Florida. Now, some of these markets have increased in excess of 20%, so investors who got into these markets a couple years ago have made a nice return, but making money is all about anticipating growth before it happens. In other words, hindsight is always 20/20, but the only thing that matters is taking action at the right time.

Killeen, Texas has recently been named one of the strongest economies in the United States. This is a great place to invest because of its low unemployment rates, no state income tax, and close proximity to Austin, Texas, which is a booming city.

I've been investing in Killeen for a few reasons. First, the entire world is now aware of the fact that Central Texas is one of the most secure areas in America, with stable economies and growth. Also, it's a strong rental market without a ton of other investors driving prices through the roof.

The Key To Cashing Five-Figure Checks

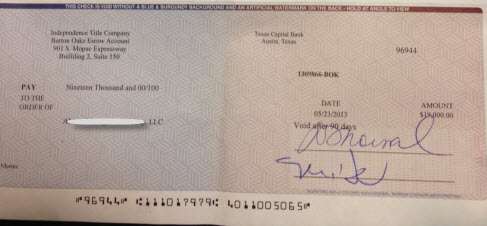

Recently, we did a flip in Austin, Texas which netted us $19,000. The beautiful part is that I got it under contract within 45 minutes of landing in Austin from my Central America diving trip.

I'm by no means a “real estate guru”, so all I can tell you is what works for me. I've found that real estate is a pure art. It's a messy and confusing business – if you're trying to do it on your own. There's no “plug and play” system or strategy that can completely automate the process – unless you have REAL PEOPLE to make the deal happen.

It's all about creating profitable deals through problem solving, and having the tenacity to see a deal from start to close. That's it.

How To Automate Your Real Estate Investing

Recently I've been overloaded with Australians, South Africans, and Americans looking to buy real estate in the good ol' United States. Thankfully there are more good deals than I can buy, so there's plenty of opportunity for everyone. My team is beginning to help foreign and domestic investors get in on the market while there's still big upside. Just contact me directly if you want to learn more about how you can invest in Turn Key Real Estate.